Gulf coast export demand drives capacity crunch

North America

Global trends

North American drayage markets face potential capacity constraints heading into Q4 as companies maintain lean inventory levels, creating conditions for sudden restocking surges if trade policies change. Drayage capacity continues to decline as owner-operators exit the market or consolidate operations. Excess capacity remains in some regions, keeping rates competitive, while tighter availability at inland rail hubs is adding volatility to appointment lead times.

Container volume trends suggest building momentum that could strain port and drayage infrastructure if restocking accelerates quickly. Canadian ports will face ongoing operational challenges with Montreal's low water levels requiring continued low water service fees from carriers. South American terminal performance will remain inconsistent through Q4 as infrastructure upgrade projects continue at key gateways.

Tariff volatility and supply chain disruptions will continue to make demand forecasting difficult, while it is anticipated that potential freight rebounds could create bottleneck scenarios if restocking demand materialises quickly.

Regional highlights

U.S. Central

Forecast: Severe congestion at the BNSF Chicago intermodal facility will continue to affect dwell times due to chassis shortages and mismatches.

Market drivers: The BNSF Chicago intermodal facility is experiencing severe congestion from chassis mismatches and shortages. Often, the right size or type of chassis isn’t available when a container arrives, causing drivers to spend extra time searching for compatible chassis equipment and waiting in long lines before they can load and move the containers. This is increasing container dwell times and reducing overall productivity at one of North America's busiest inland rail hubs. To alleviate overflow conditions, CSX is using Fort Hill Yard to manage excess containers from Bedford Park, while Norfolk Southern has reopened a container pickup-only lot near the Inman Terminal in Atlanta to support Chicago operations. These overflow management measures indicate sustained pressure on Chicago's intermodal infrastructure.

U.S. East Coast

Forecast: Drayage operations face potential regulatory disruption as New Jersey proposes independent contractor classification changes. This would significantly impact owner-operator availability. Driver capacity constraints are expected to worsen if proposed regulations are finalised before November 2025. Charleston will continue to face longer drayage distances and increased truck reliance due to ongoing infrastructure delays.

Market dynamics: The New Jersey Department of Labour has proposed new rules for independent contractor classification, similar to California’s AB5 law. If implemented, many owner-operators could be reclassified as employees. This is a major concern for the intermodal sector, where more than 80% of drivers currently operate as independent contractors (IANA).

The proposed “ABC test” would prevent contractors from performing the same core functions as the companies that hire them, limiting drivers’ ability to haul for multiple customers. With driver shortages already projected to nearly double—from 78,000 in 2022 to 160,000 by 2031—forced reclassification could further tighten capacity, disrupt operating models and lead to higher drayage costs for shippers.

Charleston’s Naval base intermodal facility, originally scheduled to open in July 2025, has been delayed to early 2026. As the only major East Coast port without on-dock or near-dock rail access, Charleston remains at a competitive disadvantage compared to other East Coast ports. This creates greater reliance on drayage and the potential for longer transit times.

U.S. Gulf Coast (USGC)

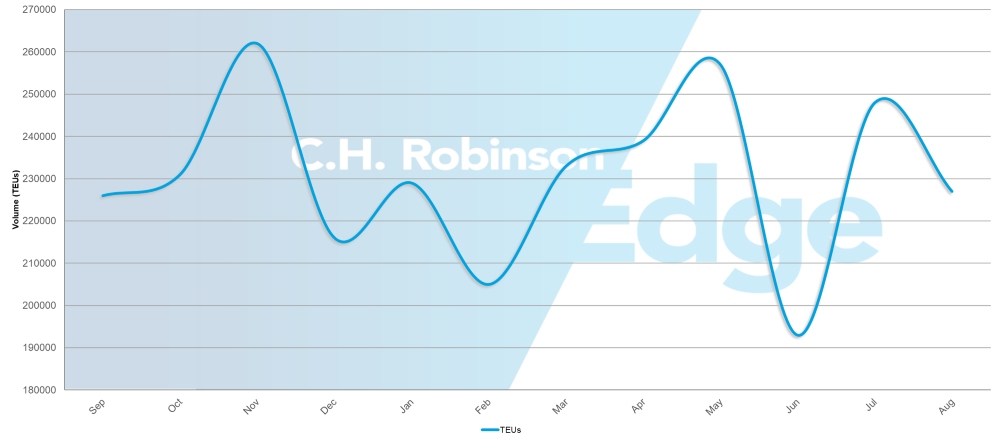

U.S. Gulf Coast container imports (TEUs)

Source: Descartes, Global Delivery Report: August 2025

Forecast: Capacity will remain severely constrained through Q4, with high export demand continuing to significantly outpace available space.

Market dynamics: High export demand from USGC ports is creating the most pronounced capacity constraints in the North American market, with available space unable to meet delivering requirements. Equipment shortages are becoming more prevalent for export operations, affecting both vessel loading and inland transportation co-ordination. The combination of strong export volumes and limited infrastructure capacity is creating bottlenecks that extend beyond the ports into regional drayage networks, affecting truck availability and extending transit times for cargo movement to and from Gulf Coast facilities.

Canada

Forecast: Port congestion conditions are improving overall, though seasonal and environmental factors continue to create operational challenges. Low water levels at Montreal may create more significant impacts on vessel operations without substantial rainfall.

Market dynamics: Exceptionally dry summer conditions have reduced water levels at Port of Montreal below normal levels, prompting carriers to implement low water service fees.

Reduced staffing levels following the Labour Day holiday weekend created temporary operational slowdowns, while the start of wildfire season poses potential risks to transportation networks. Recent arbitration decisions have resolved labour disputes with Canadian Pacific Kansas City (CPKC) and Canadian National Railway (CN), establishing new contracts through 2026-2027 and eliminating rail strike risks that could disrupt cargo movement between ports and inland destinations.

Regional performance:

- British Columbia: Container dwell times vary significantly across terminals, with Vancouver experiencing the longest delays and smaller terminals showing better performance. Emergency rail service is available when standard rail capacity is constrained.

- Eastern Canada: Toronto provides the fastest container processing, while Montreal and Saint John maintain moderate dwell times. Halifax terminals face the longest delays in the region, particularly at Atlantic Hub operations.

Mexico

Forecast: Manzanillo will continue experiencing congestion affecting both loading operations and transshipment services through Q4. Schedule instability is expected to persist due to operational challenges.

Market dynamics: Manzanillo serves as a critical transshipment hub for cargo moving between Asia, North America and South America, making congestion at this facility particularly disruptive to integrated delivery services. The port's congestion is affecting both direct cargo operations and connections to South America, creating cascading delays across multiple trade lanes. Loading and transshipment operations will face continued bottlenecks that extend transit times for cargo moving through Mexico's primary Pacific Coast gateway.

Key takeaways

Shippers should prepare for potential capacity constraints and rate increases in Q4 as restocking demand builds and drayage capacity remains reduced from operator consolidation. Companies with lean inventories should consider gradual restocking strategies rather than waiting for potential tariff relief that could trigger sudden demand surges.

East Coast operations face potential regulatory disruption from New Jersey's proposed independent contractor classification changes that could worsen driver shortages and increase drayage costs if finalised before November 2025. Charleston routeing may face extended transit times due to continued reliance on drayage without on-dock rail access, while Chicago operations will require additional dwell time planning due to chassis availability challenges. Gulf Coast exporters should expect severely constrained capacity with equipment shortages affecting both vessel loading and inland co-ordination.

Canadian shippers should plan for longer transit times through Vancouver and Halifax terminals while leveraging Toronto's efficient connections for Eastern Canada destinations and factor in low water service fees at Montreal. Mexican routeing through Manzanillo will require additional transit time planning due to ongoing congestion affecting both direct operations and South American connections.

Europe

Global trends

European port and drayage operations are entering Q4 under mixed conditions. Congestion challenges persist at major gateways, even as labour conditions have improved following the end of summer holidays. Terminal operations at key north European ports remain constrained, while staffing levels have stabilised. Meanwhile, hinterland transportation networks—including rail, barge and truck connections—continue to experience bottlenecks that extend beyond the terminals, affecting access to critical delivery hubs. Although some ports are showing gradual operational improvements, the largest facilities are still handling elevated cargo volumes, putting pressure on processing capacity and contributing to longer dwell times.

Regional highlights

North Europe

Forecast: Terminal congestion will persist at Hamburg and Rotterdam with delays up to five days through Q4. Hinterland connection bottlenecks will continue affecting rail, barge and truck access to major north Europe ports.

Market dynamics: Hamburg and Rotterdam have experienced worsening congestion compared to other European ports, extending dwell times for import and export cargo. The largest operational bottlenecks occur at hinterland connections where rail, barge and truck services connect to main north Europe ports. However, the end of summer holidays has provided a positive impact on labour shortages, improving staffing levels at terminals and supporting more consistent operations compared to peak summer months when reduced workforce availability compounded congestion challenges.

South America

Global trends

South American port and drayage operations face widespread infrastructure-related challenges through Q4 as major gateways undergo necessary modernisation projects. Terminal performance will remain inconsistent across the region, with infrastructure upgrades creating temporary operational constraints that affect cargo processing times and throughput capabilities. These improvement projects, while essential for long-term capacity expansion, are creating bottlenecks during the construction period that impact both vessel operations and inland transportation networks. Weather-related disruptions continue affecting Pacific Coast operations, adding operational complexity to already constrained terminal facilities.

Regional highlights

South America West Coast (SAWC)

Forecast: Terminal performance will remain inconsistent across major SAWC gateways through Q4.

Market dynamics: Infrastructure projects are creating operational constraints at key terminals.

Regional performance:

- Callao, Peru: Will continue experiencing delays through Q4, with extended cargo processing times and bottlenecks.

- Buenaventura, Colombia: Operations will face ongoing efficiency challenges—delays in cargo handling and overall throughput performance—during infrastructure upgrades.

Key takeaways

South American companies should account for additional processing time at Callao and consider alternative routeing through other gateways when using Buenaventura during infrastructure upgrades.

Download slides

Download slides